How to Change Ownership of a Google Drive Folder or File

Unlocking Collaboration: A Guide to Transferring Ownership of Google Drive Files and Folders In the dynamic landscape of digital collaboration, Google Drive stands as a cornerstone, empowering users to share and collaborate on documents seamlessly. As projects evolve and team structures shift, the need to transfer ownership of Google Drive files and folders may arise. … Read more

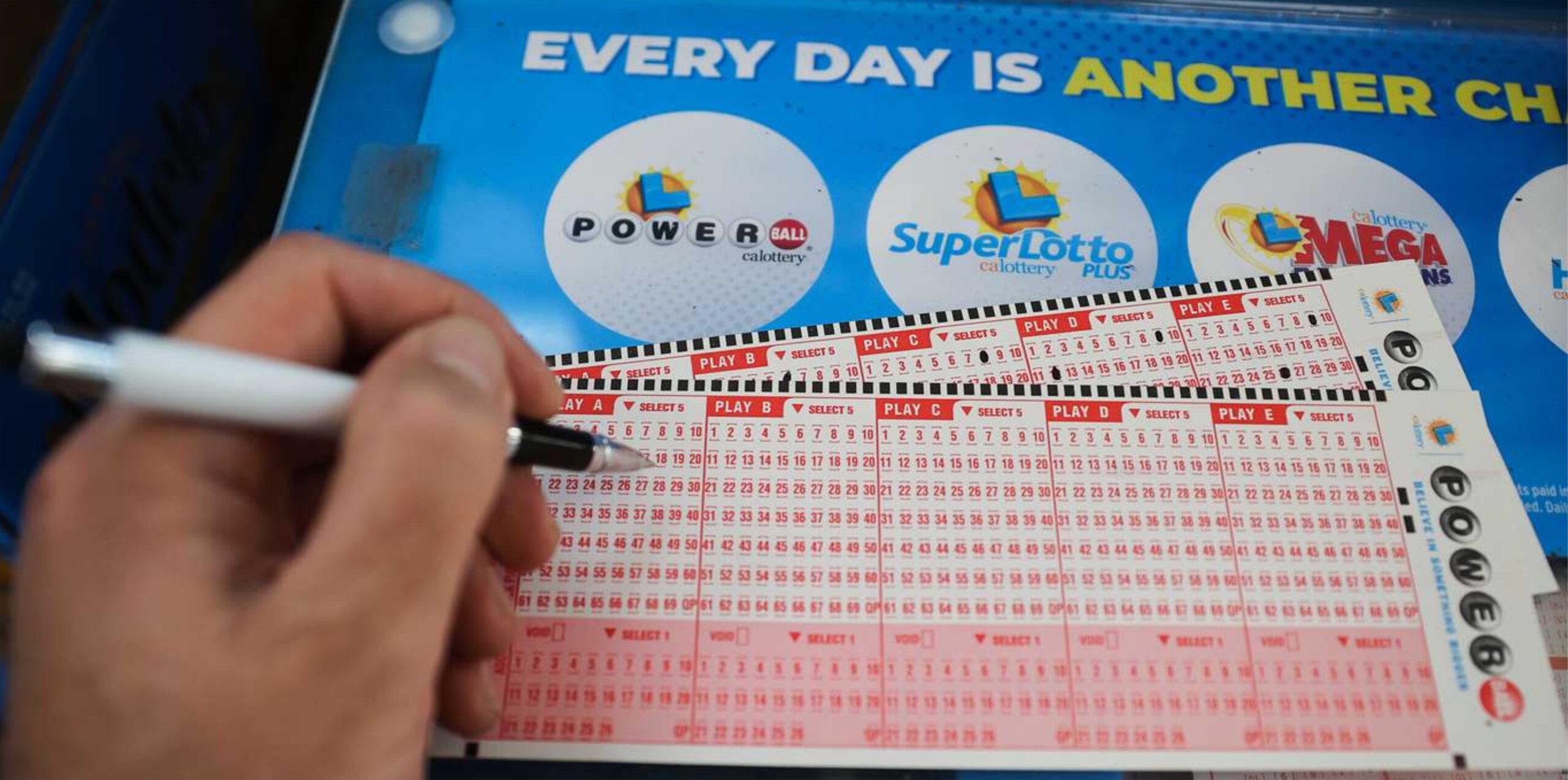

Historic Powerball Jackpot: Michigan Claims $842 Million on New Year’s Day

Johnston, Iowa (AP) — In a remarkable start to 2024, the Powerball lottery game witnessed a historic moment as a whopping $842.4 million jackpot was clinched by a fortunate individual in Michigan. This milestone victory marks the first time the Powerball jackpot has been won on New Year’s Day since its inception in 1992 The … Read more

Roblox Unblocked: Unblocking with NordVPN

Roblox and many other games, apps, and websites are blocked in many regions of the US and some other countries. Here is a guide to unlocking or unblocking Roblox and almost all the blocked websites and apps in your area using a VPN. When we talk about VPNs the top of the list of best … Read more

Prime Drinks Controversy|Debate over Caffeine and Marketing Tactics

In the ever-evolving landscape of beverage trends, Prime drinks, the brainchild of YouTube personalities Logan Paul and Olajide Olatunji (KSI), have surged into the limelight, captivating the attention of millions, especially among the younger demographic. However, the journey to popularity for these influencer-backed beverages has not been without its fair share of controversy, prompting a … Read more

Hostinger Discount Coupon Code in 2023-2024!Unlock Savings with the Best

Are you ready to embark on your online journey with Hostinger, one of the leading web hosting providers? We’ve got exciting news for you! As you gear up to launch your website or take your online presence to the next level, we’ve uncovered the key to unlocking incredible savings – the best Hostinger discount coupon … Read more

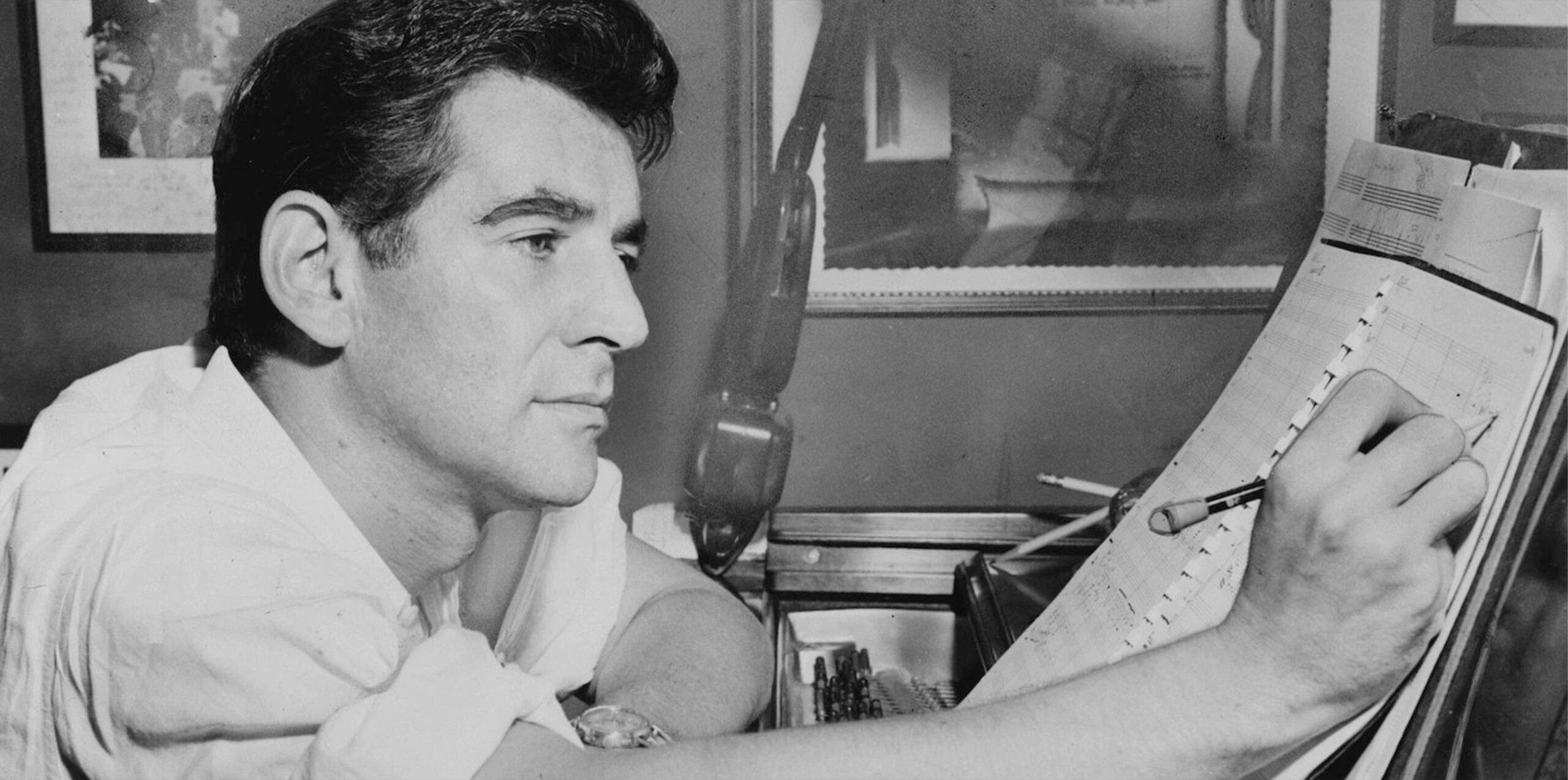

Jamie Bernstein Explores ‘Life With Father’ Leonard Bernstein

In a heartfelt piece featured in the August 2008 issue of Town & Country magazine, Jamie Bernstein, daughter of the legendary composer and conductor Leonard Bernstein, invites readers into the harmonious tapestry of her life with her iconic father. As the world delves into the intimate reflections shared by Jamie, the article provides a rare … Read more

Rediscovering Timeless Masculinity with Brut Signature Cologne

In the realm of men’s grooming, certain names evoke nostalgia and a sense of timeless elegance. Brut, a brand that has graced the shelves since 1964, is one such name. Let’s delve into the world of Brut Signature Cologne, an iconic fragrance that has become a rite of passage for many men, embodying the essence … Read more

Unveiling Excellence: Grizzly Tools Dominates the Craftsmanship Realm

In the world of woodworking and metalworking, one name stands tall—Grizzly Industrial, Inc. Renowned for its unwavering commitment to providing top-notch machinery, tools, and accessories, Grizzly has become a beacon for both seasoned craftsmen and hobbyists alike. The Grizzly Touch: Unveiling Craftsmanship Excellence Grizzly Industrial, Inc., established as a family-owned business in 1983, has evolved … Read more

Navigating Costco Gas Station Hours

Before we delve into the art of minimizing wait times and optimizing your Costco gas station visit, let’s lay out the groundwork. Here’s a handy timetable outlining the typical operating hours for Costco gas stations: Days Opening Time Closing Time Monday 6:00 AM 9:30 PM Tuesday 6:00 AM 9:30 PM Wednesday 6:00 AM 9:30 PM … Read more